Tianjin Updates

2025-09-25

'Chinese Bridge' contest showcases 76 international students in Tianjin

At the ongoing fifth "Chinese Bridge" Chinese Show for Foreign Primary School Students? in Tianjin, 76 contestants from 63 countries showcased their Chinese language proficiency and shared personal stories connected to Chinese culture.

read more- China announces a series of policy steps to back private firms and venture capital

- Montenegrin student wins international Chinese proficiency competition

- Breakthrough reached in propylene production

Copyright ©? Tianjin Municipal Government.

All rights reserved. Presented by China Daily.

京ICP備13028878號-35

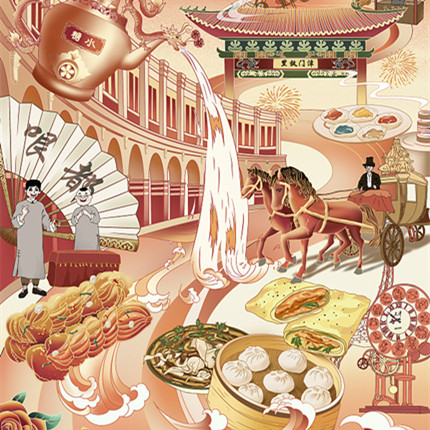

Why Tianjin

Why Tianjin Investment Guide

Investment Guide Industry

Industry Industrial Parks

Industrial Parks

Health

Health Visas

Visas Education

Education Sports and recreation

Sports and recreation Adoption

Adoption Marriage

Marriage